AMOEBA announces the initiation of coverage by Portzamparc – BNP Paribas Group

Chassieu (France), April 20, 2023 – 17h45 – AMOÉBA (FR0011051598 – ALMIB) an industrial biotech in pre-commercialization* specialized in the treatment of microbiological risk, developing a biocontrol agent for the treatment of plants in agriculture and a biological biocide for the treatment of industrial water, announces today that Portzamparc – BNP Paribas Group has initiated coverage on the company.

Portzamparc – BNP Paribas Group began its monitoring with a “Buy” recommendation and a study entitled: “the amoeba at the service of the environment”.Portzamparc ‘s study is available on Amoéba’s website in the “Shareholding / Coverage” section.

Ordinary and extraordinary general meeting to be help on 25 May 2023

MODALITIES THROUGH WHICH THE PREPARATORY DOCUMENTS WILL BE MADE AVAILABLE

Chassieu, 19 april 2023

The company’s shareholders are invited to attend the ordinary and extraordinary general meeting which will be held on:

Thursday 25 may 2023 – 9 am

at the company registered office – 38 Avenue des Frères Montgolfier- 69680 CHASSIEU

The notice of the meeting as a notice of convocation, including the agenda and the planned resolutions, was published in the BALO (Bulletin of obligatory legal announcements) of 19 april, 2023.

The documents stipulated by article R.225-83 of the French commercial code are available to shareholders from the moment that the assembly is convened, in line with the applicable regulatory requirements:

- Any registered shareholder can, until the fifth day (inclusive) before the assembly, ask the company to send him these documents. For holders of bearer shares, this right can only be exercised upon presentation of a statement of participation in the accounts of bearer shares held by the authorised intermediary;

- Any shareholder can consult these documents at the company’s headquarters during the 15 days preceding the date of the meeting.

For information, electronic voting via the VOTACCESS secure voting platform for the General Meeting of Thursday, May 25, 2023 will be open from May 3, 2023 until Wednesday, May 24 2023 at 3:00 pm (Paris time). Shareholders wishing to use this platform can consult the access conditions in the notice of meeting and on the company’s website (https://amoeba-nature.com/investisseur/assemblee-generale).

AMOÉBA announces the availability of the 2022 Universal Registration Document including the Annual Financial Report

Lyon (France), April 18, 2023 -5.45 pm- AMOÉBA (FR0011051598 – ALMIB), an industrial biotech in pre-commercialization* specialized in the treatment of microbiological risk, developing a biocontrol agent for the treatment of plants in agriculture and a biological biocide for the treatment of industrial water , announces that the 2022 Universal Registration Document was filed with the French Financial Markets Authority (Autorité des marchés financiers-AMF) on April 18, 2023 under number D.23-0296.

The 2022 Universal Registration Document includes:

- the Annual Financial Report comprising the consolidated financial statements, the parent company financial statements, the management report and the related statutory auditors’ reports

- The Board of Directors’ corporate governance report

The Universal Registration Document 2022 also presents the company’s activities, particularly in the development of the biocidal and biocontrol applications and its research works. The organisation, financial situation, results and prospects of Amoéba are also described in the Document.

The document may be viewed or downloaded on the company’s website www.amoeba-nature.com under section “Investors / financial documents/ Reference Document”. Copies of the Universal Registration Document are also available at the company’s headquarters: 38, avenue des frères Montgolfier, 69680 Chassieu, France.

Next event: General Meeting of Shareholders: 25 May 2023

Amoéba announces its collaboration with Nissan Chemical Corporation for the biocontrol application.

Lyon (France), March 31st, 2023– 08h30 – AMOÉBA (FR0011051598 – ALMIB) an industrial biotech in pre-commercialization* specialized in the treatment of microbiological risk, developing a biocontrol agent for the treatment of plants in agriculture and a biological biocide for the treatment of industrial water, announces that, in the framework of a Material Transfer Agreement, Nissan Chemical Corporation has started a performance evaluation study of the mixture of one of its products with an Amoéba biocontrol experimental product.

The aim of this evaluation is to determine the performance in controlling grapevine downy mildew of the combination of Nissan Leimay® product (suspension concentrate at 200 g/l amisulbrom) and Amoéba AXP12 experimental product (suspension concentrate at 215 g/l lysate of Willaertia magna C2c Maky),

This extemporaneous mixture was tested in two trials against grapevine downy mildew in Italy, in conditions of high disease pressure. Ten applications at 7-day intervals were made.

The combination Leimay®+ AXP12, tested at a reduced dose of both products, was very efficient on leaves and bunches. It is superior to Leimay® and AXP12 used alone at their full dose, which could allow a reduction in the dose of either or both products.

Moreover, the performance of this mixture is significantly better than the reference product of the trials, copper hydroxide (at the rate of 200 g active ingredient/ha/treatment).

These results support the continuation of the experiment in 2023.

Amoéba : 2022 annual results – An exceptional year which confirms Amoéba’s potential

Obtention of two marketing approvals in the USA (biocide and plant protection) and a recommendation for approval of the biocontrol active substance in Europe

Chassieu (France), March 30th, 2023 – 17:45 – AMOÉBA (FR0011051598 – ALMIB), an industrial biotech in pre-commercialization* specializing in the treatment of microbiological risk, developing a biocontrol agent for the treatment of plants in agriculture and a biological biocide for the treatment of industrial water, today announces its annual results for the year ending 31 December 2022.

The Board of Directors, which met on 30 March 2023, approved the corporate and consolidated financial statements of the Amoeba Group for the year ended 31 December 2022.

The Statutory Auditors have carried out their audit work and have not identified any significant anomalies that would call into question the conformity of the financial statements. The certification reports are being issued

A financial position strongly improved by debt repayment and equity rebuilding

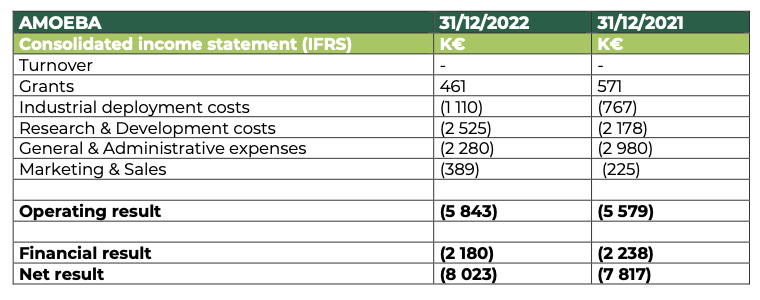

At 31 December 2022, Amoéba’s operating profit was -5,843 K€ compared to -5,579 K€ at 31 December 2021

- The company did not generate any revenue in the financial year 2022.

- Subsidies are down compared to 2021. They are mainly made up of the Research Tax Credit and underline the continued efforts made by the company in terms of research and development on its biocontrol application during 2022.

- Industrial deployment costs are up on the previous year and reflect the start of pre-industrialization of the biocontrol product developed by the Company.

- Research and Development expenses amount to €2,525K, up from €2,172K in 2021. This increase is mainly due to the external services provided to validate the field trials of the biocontrol product.

- General and administrative expenses amounted to €2,280k, down by €700k on the previous year.

- The increase in marketing and sales costs is mainly due to the strengthening of the team for pre-commercialization.

- The financial result mainly includes interest charges related to bank loans (€1,027k) and the OCAPI transaction (€1,153k).

The net result thus amounts to -€8,023k compared to -€7,817k at 31 December 2021.

At 31 December 2022, the company’s shareholders’ equity amounted to €8.2m compared with €0.2m at 31 December 2021.

The company’s financial debt amounted to €2.4m (compared to €12.5m at 31 December 2021) and is mainly made up of the bond loan resulting from bonds issued and not yet converted at the end of the year (€2.1m) and debts linked to lease obligations (€0.3m).

The Company’s cash position at 31 December 2022 was €5,528k compared with €7,275k at 31 December 2021.

An exceptional year marked by two marketing approvals in the USA (biocide and plant protection), the recommendation for approval of the biocontrol active substance in Europe and further development of pre-commercial field tests

During the year 2022, Amoéba focused on the following main areas:

1 – Biocontrol application

Sustainability of the company through regulatory announcements:

- On 25 April 2022, the Company announced that AGES (Agentur für Gesundheit und Ernährungssicherheit ), the competent authority of the Reporting Member State (Austria) in charge of the application for the biocontrol active substance “Willaertia magna C2c Maky Lysate”, recommends its approval for plant protection use in the European territory.

- In its draft assessment report, AGES concludes that the active substance is likely to meet the approval criteria. The Austrian authority thus confirms the efficacy of the active substance and its lack of adverse effects on human health and the environment when used according to good plant protection practice and under realistic conditions of use.

- On 29 September 2022, the company received a positive pre-decision from the US Environmental Protection Agency (US EPA) following the evaluation of the application for Willaertia magna C2c Maky as a biocontrol active substance (biopesticide) for use in agriculture. The EPA concluded that Willaertia magna C2c Makylysate has a low toxicity profile for human health and the environment, and that “its mode of action contributes to its attractiveness as a viable alternative to conventional pesticides, making it a valuable addition to the pesticide panel. Therefore, EPA is proposing to grant unconditional registration of Willaertia magna C2c Maky lysate as a new active ingredient in food and non-food plant protection uses.

- On 12 October 2022, following its favourable pre-decision, the EPA approved the maximum residue limit exemption (tolerance exemption) of Willaertia magna C2c Maky amoeba lysate, corresponding to the regulatory threshold of pesticide residue concentration, above which the marketing of a food product is no longer authorized.

- On 3 November 2022, the Company informed that the US Environmental Protection Agency (US EPA) has approved the use of the amoeba lysate Willaertia magna C2c Maky as an active substance for use in plant protection.

Recognition of its scientific expertise:

- On 18 October 2022, the Company announced the publication of a peer-reviewed scientific paper on its biocontrol application (https://www.mdpi.com/2223-7747/11/20/2756/pdf ) in the special “Plant Bioprotection” issue of Plants, the journal of the MDPI Group.

This article presents, for the first time to the international scientific community, the efficacy of Amoeba’s biocontrol products based on the lysate of the amoeba Willaertia magna C2c Maky on potato late blight.

The scientific data demonstrating the double mode of action of the lysate to control potato late blight are presented:

– On the indirect effect via the stimulation of the plant’s natural defences

– On the direct fungicidal effect against the pathogen Phytophtora infestans responsible for potato late blight.

An acceleration of field trials, synonymous with a record year:

- On 20 October 2022, the company announced the results of the field trial campaign.

With more than 120 field trials completed or underway in Europe, the United States, Brazil, Costa Rica and Asia, the winter 2021/summer 2022 field trial campaign is the largest ever undertaken by Amoéba.

The main objectives of these trials conducted by independent external service providers in small plots under GPE (Good Experimental Practice) guidelines were:

- To generate efficacy data for future marketing authorization applications (MA) in Europe, Brazil and California

- To evaluate the company’s formulations on new targets, in particular diseases of tropical crops, apples and certain vegetable crops.

To conduct parallel positioning trials in combination or in programs with other fungicides (notably on vines, potatoes, wheat, vegetables and soybeans), foreshadowing experiments closer to practical application.

2 – Biocide application

A strategic repositioning following regulatory announcements:

- On 3 May 2022, the Company announced that the MCCAA (Malta Competition and Consumer Affairs Authority), the competent authority of the reporting Member State (Malta) evaluating the application for approval of the biocidal active substance “Willaertia magna C2c Maky“, recommended its non-approval for biocidal use in cooling towers in Europe. On the basis of the application dossier for approval of the biocidal active substance “Willaertia magna C2c Maky“, the Maltese authority concluded in its draft report that the active substance is not likely to meet the approval criteria, considering that the innate efficacy has not been sufficiently demonstrated and that a Trojan horse effect cannot be excluded under realistic conditions of use.

- On 10 August 2022, the Company announced that the US Environmental Protection Agency (US EPA) has issued a favourable pre-decision following the evaluation of the application for authorization of Willaertia magna C2c Maky as a biocidal active substance in cooling systems.

As a result of this favourable EPA pre-decision and the public consultation required for any new active substance, completed on 3 December 2022, the amoeba Willaertia magna C2c Maky and BIOMEBA products containing it are now authorized in the United States for biocidal use in closed cooling systems, for the control of microbial slime, for the control of microbial induced corrosion and for the control of general microbial life.

- On October 19 2022, the Company announced that it would not pursue its live amoeba biocide application in Canada. Amoeba has decided to permanently withdraw the application for registration in Canada and to focus its resources on low regulatory risk applications.

3 –Securing the Company’s financing

- The Company announced the issuance of the fourth, fifth and sixth tranches of 60 convertible bonds and a seventh tranche of 40 convertible bonds as part of its incentive bond financing with Nice & Green.

- In addition, Amoéba finalized the restructuring of its debt by prepaying the entire EIB loan.

Developments and prospects

1 – Biocontrol application

The company is preparing to carry out a new field test campaign for its biocontrol product in 2023.

The program planned for 2023 will focus on the following themes:

– Completing and generating data for future marketing authorization dossiers in Europe and California

– Confirm in the second year the new strong points identified in 2022 (soybean rust, banana Sigatoka, apple scab, etc.)

– In vines and vegetables in Europe, test the inclusion of the Amoeba product in practical treatment programs: either in small plot trials under Good Experimental Practice or under real agronomic conditions with the farmer’s equipment

In Europe, the collective peer review of Austria’s draft report is underway and should be finalized in Q3 2023.

This should be followed by two further phases:

| Publication of the review report by the European Commission and implementing regulation carrying the European Commission’s decision | S1 2024 |

| Decisions on authorizations of products containing the active substance “Willaertia magna C2c Maky lysate” by targeted Member States | 2024 |

Applications for authorization of biocontrol products will be submitted in 2023 in the targeted member states: submission is indeed possible before the active substance is approved by the European Commission.

In the US, an application for approval of biocontrol products is expected to be submitted, following the approval of the active substance by the US EPA in 2022.

2 – USIBIAM industrialization project and search for financing

On January 27, 2023, the Company announced that it had terminated its convertible bond contract with Nice & Green SA and waived the issuance of the optional 8th tranche of 80 OCAs as initially foreseen in the contract[i].

Amoeba’s ambition is to build « USIBIAM » a production plant dedicated to biocontrol products, which could initially produce 40 tones of active substance per year, i.e. 200 tones of finished product, making it possible to treat 100,000 hectares. The company could increase its production and cover up to 200,000 hectares if the site is expanded. This production site should be operational by early 2025 in order to start marketing its biocontrol products as soon as marketing authorizations are obtained in Europe and the United States.

In order to finance this production site and to continue its operational and research activities over the next 3 years, the company estimates its total financial needs at €45 million – without extension-(€23 million in capital expenditure and €22 million in operational expenditure).

In order to adapt its financial strategy to its new industrial transformation challenges, Amoéba has concluded a support contract with Redbridge Debt and Treasury Advisory to assist it in its search for financing[ii].

Pending the search for and obtaining of such financing, on February 15, 2023, Nice & Green SA[iii] agreed to continue supporting Amoéba within the framework of a debt financing in the form of a simple bond loan with, as an exclusive repayment guarantee, a commitment to issue share warrants in the event of Amoéba’s failure to repay the simple bonds (OS) at their maturity. This interim financing of €9 millions allows the company to immediately start its industrial project and to cover its expenses until December 2023. It is intended to be automatically repaid as soon as Redbridge Debt and Treasury Advisory has structured a financial contribution.

On 16 February 2023, the Company announced that it had submitted the building permit for its new production site dedicated to biocontrol applications, based in Cavaillon in the Vaucluse.

On 29 March 2023, Amoéba announced its nomination as a winner of the France 2030 project following its application to the “Resilience and Agri-food Capacity” call for projects. After examining the application, BPI France recognized the quality and interest of Amoéba’s investments, a key player in the agro-ecological transition, and announced support of €5,917,676 in the form of a €3,550,606 grant and €2,367,070 in recoverable advance.

3 – Biocide application

Following the US EPA’s preliminary favourable decision on the use of the amoeba Willaertia Magna C2c Maky in closed cooling systems (see press release of 10 August 2022), Amoéba initiated a search in 2023 for a partner capable of taking over the production and/or marketing of the biocide product in the United States. This search is still ongoing.

4 – New applications

In addition to existing applications (biocide and biocontrol), Amoéba receives numerous requests to integrate its solution into new fields of operations. A strict scientific evaluation of these opportunities is carried out permanently by our laboratory and external expert laboratories.

At the date of closing the accounts, the Company has sufficient net working capital to meet its obligations and cash requirements over twelve months, believing that it can meet its commitments until December 2023. The financial statements for the year ended 31 December 2022 were approved by the Board of Directors on 30 March 2023 on a going concern basis in light of the business and cash flow forecasts.

Next event: General Meeting of Shareholders: 25 May 2023

[i] See press release of 21 december 2020

[ii] See press release of 27 january 2023

[iii] As a reminder, Nice & Green SA is an unregulated service provider and investor specialising in the structuring and financing of small and medium-sized listed companies, investing in particular in the medical science and technology sectors.

Amoéba obtains €5.9 million in funding from BPI France as part of France 2030 program

Chassieu (France), March 29th, 2023 – 17:45 – AMOÉBA (FR0011051598 – ALMIB), an industrial biotech in pre-commercialization* specializing in the treatment of microbiological risk, developing a biocontrol agent for the treatment of plants in agriculture and a biological biocide for the treatment of industrial water, announces the support of BPI France in the framework of the national financing plan “France 2030”.

Presented in October 2021, the “France 2030” financing plan aims to provide answers to the major challenges of our time, while raising France to the rank of leader in its industry through three levers: reindustrialising France, investing massively in innovative technologies and supporting the ecological transition.

As a result of its application to the « Résilience et Capacité Agroalimentaire » appeal, Amoéba has officially been nominated as the laureate of the France 2030 project. After examining the application, BPI France recognised the quality and interest of Amoéba’s investments, as it is a key player in the agro-ecological transition, and announced a support of €5,917,676 in the form of a €3,550,606 subsidy and a €2,367,070 recoverable advance. At this stage, the company is still pending the terms and timing of the payment of these amounts.

This financing will enable the company to further its industrial project, in particular the creation of its eco-responsible plant, located in the new business park “Hauts Banquets” in Cavaillon, dedicated to naturalness. In addition to the environmental nature of the project, Amoéba’s industrialisation meets the innovation criteria of France 2030, with 4.0 facilities and the use of artificial intelligence solutions.

As a reminder, in order to finance its future production site and pursue its operational and research activities over the next three years, the company estimates its total financial expenditure at 45 million euros. Amoéba is currently pursuing its research for the required financing(s).

By industrializing the production of biocontrol solutions in France, Amoéba is committed to putting all its efforts into biological, autonomous and safe agriculture, and to meeting the European objectives of a 50% reduction in the use of pesticides in Europe by 2030, a 25% of cultures treated in Organic Agriculture in Europe by 2030 and the securing of food inputs in Europe.

NEXT APPOINTMENT : March 30th, 2023 – 2022 Annual results

This project was supported by France 2030

AMOEBA announces initiation report from the analyst Edison Group

Lyon (France), March 13th, 2023 – 17:45 – AMOÉBA (FR0011051598 – ALMIB), an industrial biotech in pre-commercialization* specializing in the treatment of microbiological risk, developing a biocontrol agent for the treatment of plants in agriculture and a biological biocide for the treatment of industrial water, announces that Edison Group, a London-based equity research house, has initiated coverage on the company.

This research contract, financed by the company, aims to allow investors to broaden their understanding of the company, which is necessary to take a position on Amoéba shares (ALMIB).

The first note, entitled “Amoéba, fighting pathogens, respecting nature” is available to all investors and provides insight into the business’ plans to raise €45m to fund its operations and expand its site over the next three years. Subsequent research will keep shareholders up to date with Amoeba’s finances, strategy and operational progress.

The company informs that, as Amoéba plans to double the size of its biocontrol plant in Cavaillon in 2027, Edison Group’s estimations on this first note are based on a production capacity allowing the treatment of 200 000 hectares.

Edison’s research is available on Amoéba’s website in the “Shareholding / Coverage” section as well as directly from the Edison website and via major financial data providers including Bloomberg.

AMOEBA submits the building permit application for its 100% biocontrol manufacturing unit in the south of France

Lyon (France), February 16, 2023 – 5:45 p.m. – AMOÉBA (FR0011051598 – ALMIB), an industrial biotech in pre-commercialization* that is specialized in the treatment of microbiological risk, developing a biocontrol agent for the treatment of plants in agriculture and a biological biocide for the treatment of industrial water, announces that it has applied for building permit for its new production site dedicated to biocontrol application, based in Cavaillon in the south of France.

Conscious of its strategic role in the emergence of a biocontrol industrial network, Amoéba aims to develop an industrial site of over 3,000 m2 dedicated to the bio-production of its biocontrol agent. This large-scale project is part of the industrialization plan initiated by Amoéba in preparation for the commercialization of its plant protection products expected in 2025.

Chassieu: A leading industrial R&D center, optimized for the future production site

The industrialisation plan set up by Amoéba aims to reach a production capacity of 200 tonnes of finished products – equivalent to 40 tonnes of active substance – in order to cover the priority targeted markets, such as vines, vegetables and aromatic plants. To ensure the success of this industrial challenge, a gradual scale-up involving the creation of a new replicable pilot line is in progress at the historic site of Chassieu.

A new industrial site meeting the highest environmental standards

Located in the South of France, Amoéba’s new production unit is part of a project that involves the creation of a business park dedicated exclusively to naturalness, as part of the “Opération d’Intérêt Régional (OIR) Naturalité”.

In accordance with the project and its environmental values, Amoéba is working on the conception of an eco-responsible industrial site, respectful of its environment and autonomous in energy. Certified “Eco Parc+”, the site is expected to meet a number of ecological challenges: the preservation and enhancement of the countryside and biodiversity, the recycling of industrial water, the use of geothermal energy and the installation of photovoltaic panels on 60% of the roof surface.

A strong territorial presence

To support its industrial development, Amoéba relies on the expertise of the local companies involved in the business park project, in particular GSE Avignon, which specializes in business property.

The factory project carried out by Amoéba will also contribute to the development of the South of France and to the attractiveness of the region through the creation of local employment: in the long term, twenty-five full-time jobs will be created in order to manage the operations of the industrial site, both in terms of infrastructure and in terms of 4.0 process control technologies.

Amoéba’s industrial project represents a cost of 45 million euros (23 million in investments and 22 million in operational expenses) covering the period 2023-2025. As a reminder, Amoéba is supported by Redbridge Debt & Treasury Advisory in finding and setting up the required financing for this project (see press release of January 27, 2023).

“Through this project, Amoéba is proud to contribute to the objectives of the reindustrialization of France and the agro-ecological transition, by anticipating economic and societal changes in plant protection and building a more viable and healthier agriculture. After a remarkable year in terms of regulations in 2022, Amoéba is entering the year of its industrialisation with determination, with a highly committed and proactive team. The construction of this ambitious industrial project is likely to be carried out from October 2023 to the end of 2024, on condition of obtaining the building permit in 2023”, says Hervé Testeil, Industrial Director of Amoéba.

AMOEBA signs a new €9 million simple bond financing agreement with Nice & Green

Lyon (France), February 15, 2023 – 8:30 a.m. – AMOÉBA (FR0011051598 – ALMIB), an industrial biotech in pre-commercialization* that is specialized in the treatment of microbiological risk, developing a biocontrol agent for the treatment of plants in agriculture and a biological biocide for the treatment of industrial water, announces the signature of a new simple bond financing agreement with the Swiss company Nice & Green SA.

As a reminder, Amoéba’s industrial project for the construction of its biocontrol production site represents a cost of around 45 million euros (23 million in investments and 22 million in operational expenses) covering the period 2023-2025.

On 27 January 2023, Amoéba entered into a support agreement with Redbridge Debt and Treasury Advisory to assist it in its search for new financing (see press release of 27 January 2023).

Pending the search for and the obtaining of the said financing, Nice & Green SA agrees to continue to support Amoéba within the framework of a debt financing in the form of simple bonds with, as an exclusive guarantee of repayment, a commitment to issue warrants in the event of Amoéba’s failure to repay the simple bonds (SBs) at their maturity.

It is further agreed between the parties that Amoéba may at any time redeem the outstanding SBs at their nominal value plus capitalised interest and terminate the contract without early redemption fee.

This interim financing allows the company to start its industrial project immediately and to cover its expenses until December 2023. It is intended to be automatically reimbursed as soon as Redbridge Debt and Treasury Advisory has structured a financial contribution of more than €40M.

Legal Framework :

Acting on the authority of the Board of Directors held on 13 February 2023 and in accordance with the provisions of Article L. 228-40 of the French Commercial Code in respect of the simple bonds and, in respect of the warrants, the 16th resolution of the Combined General Meeting of shareholders of 24 May 2022 relating to the authorisation to issue, with cancellation of the preferential subscription right, ordinary shares or any securities giving access to the share capital or to the allocation of debt securities in favour of categories of persons, the Company has signed on February 14 2023 a contract for the issuance of Simple Bonds (SBs) for a maximum nominal amount of €9,000,000, divided into three tranches of €3,000,000 each, the drawing of which is at the discretion of the Company.

Characteristics of Simple Bonds :

In accordance with the terms of the Contract, Nice & Green SA has undertaken, except in the case of the usual defaults, to subscribe to 300 SBs in three tranches, each comprising 100 SOs, according to the following schedule.

| Tranche | Date of issue | SB |

| Tranche 1 | Between june 30 and august 31,2023 | 1 à 100 |

| Tranche 2 | Between sepember 1st and november 30,2023 | 101 à 200 |

| Tranche 3 | Between december 1st 2023 and Marche 1st 2024 | 201 à 300 |

SBs have a nominal value of thirty thousand (30,000) euros each. They will be subscribed at a unit price equal to ninety-four percent (94%) of their nominal value, i.e. twenty-eight thousand (28,200) euros each.

The contract does not provide for a commitment fee and no obligation on the part of Amoéba to issue the agreed SBs.

Each SB has a maturity of thirty (30) months from the date of issue.

The SBs will bear interest at the 6-month EURIBOR rate on the date of each drawdown plus 600 basis points.

Amoéba will reimburse in cash the SBs from the expiry of a period of six months after the date of issue of each tranche on a straight-line basis through the payment of 8 quarterly instalments.

Thus, the first repayment date for an amount of approximately EUR 430,000 (at the current EURIBOR rate) will be 31 March 2024 at the earliest.

In the event of a total or partial default on a quarterly payment due by Amoéba to Nice & Green SA, the lender will have the option of either pursuing an action for recovery of its bond debt or exercising its right to request the issuance of warrants, which will allow for the subscription of shares in the Company, the equivalent value of which will correspond to the lender’s bond debt.

Risks associated with the operation :

- • Risk related to the issuance of the OS: Taking into account the current Euribor rates, the interest rate of the OS would be around 9% to date

- • Risks related to the issuance of the warrants in the event of default on one or more maturities: In the event of the issuance of new shares resulting from the exercise of the warrants, the shareholders could see their stake in the Company’s share capital diluted.

As a reminder, the Company’s Universal Registration Document filed on 12 April 2022 with the Autorité des Marchés Financiers under number D22-0280 and registered on the Company’s website presents the main risk factors relating to the Company.

« This line of financing will allow Amoéba and Redbridge to find and finalize the necessary financing for the implementation of our industrial project. We are delighted to be supported by Nice & Green SA, which once again proves its confidence in Amoéba and its development project“, says Valérie FILIATRE, Deputy Managing Director of Amoéba.

Update on the 2020 convertible bond contract

As a reminder, Amoéba had signed on December 16, 2020 a contract for the issuance of bonds convertible into shares (the “OCA”) with Nice & Green SA (see press release of December 21, 2020).To date, the 7 tranches issued under this contract have all been converted between 29 April 2021 and 6 February 2023. This contract has been terminated without penalty or breakage cost.

Reminder of the financial calendar:

- March 30, 2023: Audited 2022 annual results

- May 25, 2023: General Meeting of Shareholders

AMOEBA: Cancellation of the issue of the 8th optional tranche of OCAs and signature of a support contract with Redbridge Debt and Treasury Advisory

Lyon (France), January 27, 2023 – 5h45 pm – AMOÉBA (FR0011051598 – ALMIB), producer of a biological biocide capable of eliminating bacterial risk in water and human wounds, and of a biocontrol product for plant protection, still in development phase, announces that it has terminated its convertible bond issue contract with Nice & Green SA and waived the issue of the 8th optional tranche of 80 OCAs as initially planned in the contract[i]. In order to adapt its financial strategy to its new industrial transformation challenges, Amoéba has concluded a contract with Redbridge Debt and Treasury Advisory to assist it in its search for financing.

As a reminder, Amoéba’s ambition is to build a production plant dedicated to biocontrol products, which could produce 40 tons of active substance per year, the equivalent of 100,000 hectares treated. This production site should be operational by early 2025 in order to start marketing its biocontrol products as soon as marketing authorisations are obtained in Europe and the United States. In order to finance this production site and to continue its operational and research activities over the next 3 years, the company estimates its total financial needs at €45 million. Amoéba has selected the independent advisory firm Redbridge Debt & Treasury Advisory to assist it in optimising its debt structure and putting in place the necessary financing.

This support should be carried out in 2 phases:

1) Search for the optimal financing strategy(ies) for Amoéba

2) Support in the structuring, promotion and execution of its financing operations until the 45 million euro envelope is obtained.

“Thanks to the financing received from Nice & Green over the last 3 years, Amoéba has been able to pursue its research and development efforts on the biocontrol application and is now entering a new phase of its industrial and commercial development. By relying on the experience of Redbridge Debt & Treasury Advisory, we hope to optimise our financing strategy and find the most suitable financing for our development“, says Fabrice PLASSON, Chairman and CEO of Amoéba.

[i] See press release of December 21, 2020