Amoéba announces the 2020 financial year results

Chassieu (France), March 26, 2021 – 8.15 am- AMOEBA (FR0011051598 – ALMIB), producer of a biological biocide capable of eliminating the risk in water and human wounds, and of a biocontrol product for plant protection, still in a development phase, announces today its 2020 annual results.

The Board of Directors, which met on 25 March 2021, approved the corporate and consolidated financial statements of the Amoeba Group for the year ended 31 December 2020.

The Statutory Auditors have carried out their audit work and have not identified any material misstatements that would call into question the conformity of the financial statements. The certification reports are being issued.

2020 results impacted by the cost of regulatory studies

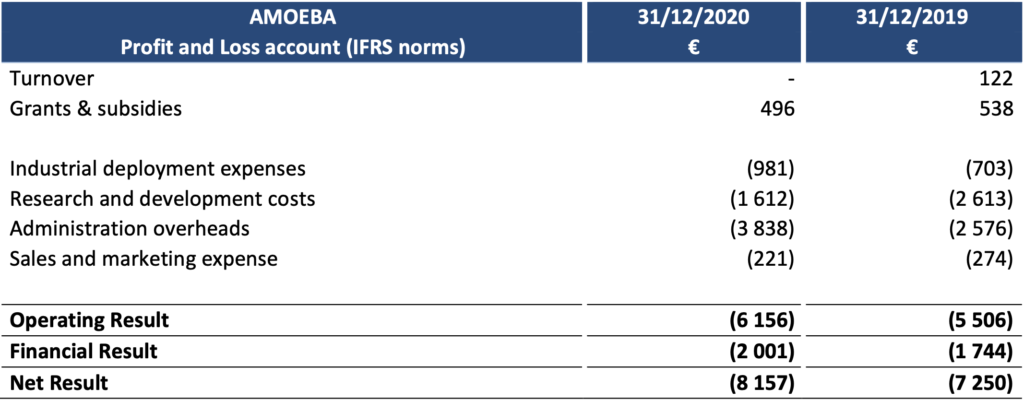

At 31 December 2020, Amoéba’s operating profit was -€ 6,156k compared to – € 5,506k at 31 December 2019.

- The company did not generate any revenue during the 2020 financial year.

- Subsidies remain stable compared to 2019. They consist of the Research Tax Credit and reflect the efforts made by the company in terms of research and development on its biocontrolapplication in 2020.

- Industrial deployment costs are slightly higher than the previous year.

- Research and Development expenses amounted to €1,612k, down compared to 2019 (€2,634k). This decrease is due to an impairment of development costs for €933k recorded in June 2019 following the withdrawal of the marketing authorization application in the United States and the subsequent postponement of production operations (see press release of 19 August 2019).

- Marketing and sales expenses (€221k) decreased (€274k in 2019).

- General and administrative expenses amounted to €3,838k, a €1,262k increase compared to2019. This variance is due to regulatory studies expenses , increased fees incurred for financialoperations and patents management.

- The financial result mainly includes interest expenses related to bank loans (€1,546k), theOCAPI transaction (€359k) and foreign exchange losses.

The net result thus amounts to -€8,157k compared to -€7,250k at 31 December 2019.

At 31 December 2020, the company’s shareholders’ equity amounted to €2m compared with €4.2m as at 31 December 2019.

The Company’s financial debt amounts to €8.6m and mainly consists of the EIB loan (€5m) and capitalised interest (€2.9m), as well as debts related to lease obligations (€0.7m).

The Company’s cash position at 31 December 2020 was €4,975k compared to €4,761k at 31 December 2019.

A year mainly marked by the development acceleration of the biocontrol application for plant protection and the regulatory dossiers follow up for the biocontrol and biocide applications.

During the year 2020, Amoéba focused on the following main areas:

1. Development accelerating of the biocontrol application for the prevention of plant diseases, in particular through research partnerships with major industrial groups

- During the year 2020, the Company announced the signature of 8 Material Transfer Agreements (MTA) with De Sangosse, Certis Europe, Stähler Switzerland, BASF, Philagro France & Nichino Europe, Evergreen Garden Care, Syngenta and Bayer. The purpose of these agreements was to supply these companies with various formulations of experimental products containing Amoeba’s active substance: the amoeba lysate Willaertia magna C2c Maky. In return, the agrochemical groups financed and conducted their own field trials to evaluate the performance of these products in preventing diseases on different crops. At the end of the testing period, 2 term sheets were signed with Philagro and Sthäler for the development and marketing of our biocontrol product against grapevine downy mildew in France and Switzerland respectively.

- The Company confirmed the efficacy of its amoeba lysate Willaertia Magna C2c Maky against grapevine downy mildew during the second field test campaign (see press release of 27 July 2020). It also announced the first efficacy results of its biocontrol solution on several major wheat diseases in its field trials (see press release dated 22 July 2020).

- On August 11, 2020, the Company announced the publication of a first peer-reviewed scientific paper on its biocontrol application (https://www.mdpi.com/2223-7747/9/8/1013/pdf) in the special issue of Plants “Natural Products for Plant Pest and Disease Control”.

- On October 1, 2020, the company filed an application for approval of the biocontrol active substance, “Willaertia magna C2c Maky lysate” and products containing it, with the US Environmental Protection Agency (EPA).

- On 7 December 2020, the Company announced the signature of a research partnership with Gowan, a leading supplier of agricultural inputs (crop protection products, seeds and fertilizers) in the United States. Amoéba and the Gowan group are thus embarking on a targeted research phase which, if successful, could promote the commercial development of Amoéba’s biocontrol solutions in the United States.

2. Follow up of the application for the biocidal application marketing authorisation

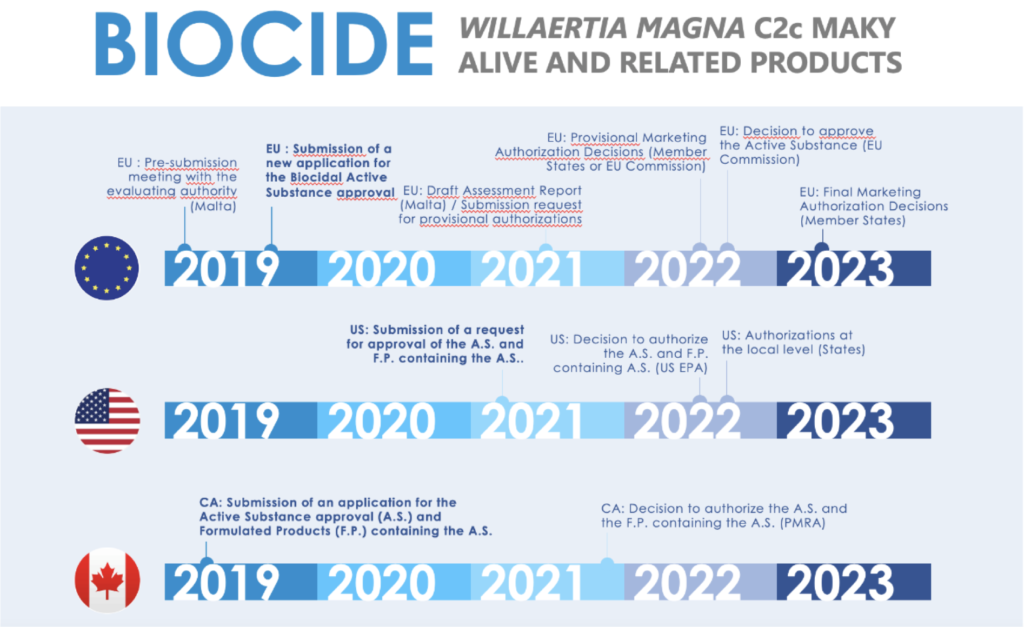

- In Europe: continued discussions with the Maltese authorities and Dutch experts. Following regular discussions and exchanges with the authorities and their experts, the Company expects to receive their evaluation report mid-2021.

- In the United States: finalization of studies and drafting of conclusions for a submission of the Biocide application planned for April 2021. At the request of the American authorities, additional studies were carried out in 2020. These studies, conducted according to an EPA protocol – in addition to the OECD studies already carried out – have once again demonstrated the harmlessness of the amoeba Willaertia magna C2c Maky. The application for marketing authorisation should be submitted to the EPA on April 2021.

3. Continued research into the knowledge of the amoeba Willaertia Magna C2c Maky

During the year 2020, the company published several scientific articles relating to the knowledge of the Willaertia magna C2c maky amoeba.

- February 2020: publication of scientific results reconfirming the direct predation and elimination effect of legionella by the amoeba Willaertia magna C2c Maky (https://www.mdpi.com/2076-0817/9/2/105).

- May 2020: publication on the transcriptome and proteome analysis of the amoeba when grown in a high-throughput bioreactor (https://www.mdpi.com/2076-2607/8/5/771/pdf).

- June 2020: publication providing further evidence of the safety of the amoeba for use in combating legionella risk (https://www.mdpi.com/2076-0817/9/6/447/pdf).

- November 2020: publication on the development and behaviour of the amoeba when industrially produced in bioreactors (https://www.mdpi.com/2076-2607/8/11/1791/pdf)

4. Transfer of the Company’s shares from the regulated market of Euronext in Paris to Euronext Growth.

At the General Meeting of 24 June 2020, the Company submitted to the vote of its shareholders, who approved it, a project to transfer the listing of its shares from the regulated market of Euronext Paris (compartment C) to the multilateral trading facility Euronext Growth Paris.

This transfer, which was completed on 14 September 2020, aims to enable Amoéba to be listed on a market more suited to its size and market capitalisation, to simplify the Company’s operations and to reduce the costs related to its listing, while allowing it to continue to benefit from the attractions of the financial markets.

5. Securing the company’s financing

- Renegotiation of the bank financing with the European Investment Bank (EIB) and signature of a contract for the issuance of Warrants to the EIB: On 31 March 2020, the Company signed an amendment to the loan agreement entered into on 6 October 2017 with the EIB for a proposed issuance of 200,000 Share Subscription Warrants (SSW) to the EIB. Under the terms of the amendment, the EIB has agreed to definitively remove the covenant to maintain the initially set up ratio between the amount of its equity capital and that of its assets. The issue of these warrants was approved by the General Meeting of Shareholders on 24 June 2020 and decided on 29 July 2020. The amendment signed between the EIB and Amoéba does not change the contractual maturity of the EIB loan scheduled for 2022.

- Bond financing:

- OCAPI 2020 plan

- The Combined General Meeting of Shareholders of March 13, 2020 approved the implementation of a new contract for the issuance of bonds convertible into shares with an incentive program (OCAPI) between Amoéba and Nice & Green SA. As of December 31, 2020, 234 bonds out of 312 initially planned have already been issued and fully converted, representing the creation of 2,783,957 new shares.

- New 2021-2022 OCAPI plan

- On December 16, 2020, the Company signed a new bond financing agreement with Nice & Green for an amount of €23 million. In accordance with the terms of the contract, the Investor has undertaken, except in the case of usual defaults, to subscribe to OCAs in tranches to be quarterly issued according to the following schedule

- six (6) initial tranches consisting of sixty (60) OCAs;

- one (1) tranche consisting of forty (40) OCAs; and

- an additional optional tranche of eighty (80) OCAs.

- This timescale allows for a regular financing of the Company while limiting the impact on the share price.

- The issuance by Amoéba of the OCAs and the possible issuance of new shares for which admission to trading will be requested, is intended to ensure the continuity of operations until September 20231 and in particular to finance:

- (i) current expenses related to the business over the financing period, including operating expenses, research and development activities on the biocontrol application as well as the application processes for the authorisation of the biocidal active substance and the biocontrol substance in Europe and the United States

- (ii) the repayment of the EIB loan and accrued capitalised interests amounting to €11.8 million scheduled for November 2022.

- On December 16, 2020, the Company signed a new bond financing agreement with Nice & Green for an amount of €23 million. In accordance with the terms of the contract, the Investor has undertaken, except in the case of usual defaults, to subscribe to OCAs in tranches to be quarterly issued according to the following schedule

- OCAPI 2020 plan

Impact of the Covid 19 health crisis on the Society’s development

From the beginning of April 2020, the production of the Company’s active substance continued under normal operating conditions. The health crisis had no impact on the preparation and monitoring of ongoing regulatory dossiers. The company made limited use of the partial activity mechanism and did not apply for a state guaranteed loan.

The Company does not market its products and does not currently recognise any significant turnover. The Covid-19 crisis therefore had little impact on its income statement.

Recent developments and prospects

As a reminder, the Company does not currently market any product and is awaiting marketing authorisations according to the schedules below:

The application procedures for the market authorisation of the biocidal and the biocontrol applications are detailed in the Universal Registration Document filed with the “Autorité des Marchés Financiers on 30 April 2020 under number D20-0416, in particular in subsection 5.4.3 “Product registration procedures”.

The company, in partnership with leading agrochemical companies, is preparing to carry out a third field tests campaign of its biocontrol product in 2021. These tests should focus on cereal diseases.

In addition to existing applications (biocide and biocontrol), Amoéba is receiving numerous requests to integrate its solution into new fields. A strict scientific evaluation of these opportunities is carried out permanently by our laboratory and external expert laboratories.

At the date of the accounts closing, the Company has sufficient net working capital to meet its obligations and cash requirements over the next twelve months, considering it should respect its commitments until September 2023. The financial statements for the year ended 31 December 2020 were prepared by the Board of Directors on a going concern basis in light of the business and cash flow forecasts.

Next meeting :

General Meeting of Shareholders: 27 May 2021