Amoéba : Issuance of the 5th tranche of OCA

Amoéba announces the issuance of the fifth tranche of 60 bonds convertible into shares.

Chassieu (France), June 13, 2022– 5.45 pm – AMOEBA (FR0011051598 – ALMIB), producer of a biological biocide capable of eliminating bacterial risk in water and human wounds, and a biocontrol product for plant protection, still in a development phase, announces the issuance of the fifth tranche of bonds convertible into shares (“OCAs”) of its new bond financing with incentive program, namely 60 OCAs numbered from 241 to 300 fully issued to Nice & Green S.A.

This issue is part of the agreement entered into with Nice & Green S.A. on December 16, 2020 with a view to setting up a bond financing with a profit-sharing program through the issuance of 480 OCAs with a nominal value of EUR 50,000 each, representing a total nominal amount of the bond issue of EUR 24,000,000 (the “Issuance Agreement”).1

The Chairman and Chief Executive Officer of the Company, using the sub-delegation granted to him by the Board of Directors at its meeting on June 24, 2021, decided to issue on June 13, 2022, 60 OCAs numbered from 241 to 300 to the benefit of Nice & Green S.A. corresponding to the fifth tranche of the bond financing.

As provided for in the issuance agreement, these OCAs were fully subscribed at a price equal to 96% of their nominal value, representing a fifth tranche of OCAs for a total net amount of EUR 2,880,000.

As a reminder, the Company maintains on its website a monitoring table of the OCAs and the number of Amoéba shares in circulation (see Investors section / Regulatories information / Other information).

As an indication, the theoretical impact of the issue of this fifth tranche of OCAs is presented in the tables below in accordance with the OCA conversion formulas on the basis of 92% of the lowest volume-weighted average trading price of the Amoéba share at closing (as published by Bloomberg) over the six (6) trading days immediately preceding June 13, 2022, namely 0.555 euros.

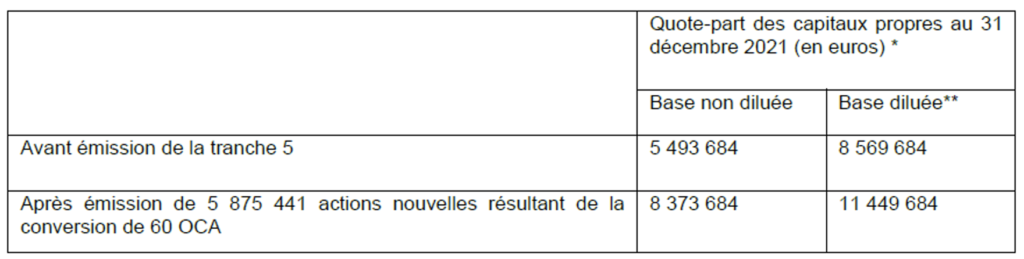

– Impact of the issue on the share of shareholders’ equity per share (calculation based on Amoéba’s shareholders’ equity as at december 31, 2021, prepared in accordance with International Financial Reporting Standards (IFRS) adjusted for capital increases completed up to June 13, 2022 i. e. 5,493,684 euros and the number of shares comprising the Company’s share capital as at June 13, 2022, i. e. 29,717,637 shares) :

(*) amount of shareholders’ equity at 31 december 2021 prepared in accordance with IFRS international financial standards and adjusted for capital increases completed until June 13, 2022

(**) assuming:

- the full exercise of the business creator share subscription warrants and share subscription warrants issued and allocated by Amoéba, exercisable or not, giving the right to subscribe for 200,000 new shares

- the definitive allocation of the conditional rights to receive 25,000 free shares fully subject to a condition of uninterrupted presence.

- the conversion of 4 bonds issued on tranche 3 and 60 bonds issued on Tranche 4 and not yet converted at june 13, 2022

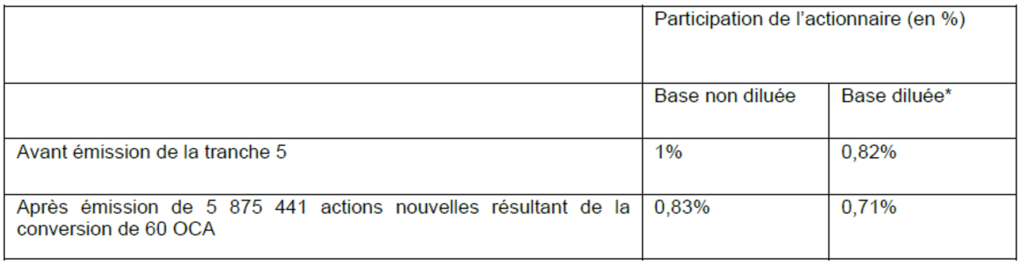

– Impact of the issue on the participation of a shareholder holding 1% of Amoéba’s share capital prior to the issue of the fifth tranche (calculation based on the number of shares comprising Amoéba’s share capital as at June 13, 2022, i.e. 29,717,637 shares) :

(*) assuming:

- the full exercise of the business creator share subscription warrants and share subscription warrants issued and allocated by Amoéba, exercisable or not, giving the right to subscribe for 200,000 new shares

- the definitive allocation of the conditional rights to receive 25,000 free shares fully subject to a condition of uninterrupted presence.

- the conversion of 4 bonds issued on tranche 3 and 60 bonds issued on tranche 4 and not yet converted at June 13, 2022.