Amoéba: first half-year reporting

Amoéba: a first half-year mainly marked by the development of the biocontrol plant project

Chassieu (France), October 5, 2023 – 18:00 CET – AMOÉBA (FR0011051598 – ALMIB), which is producing a biological biocide capable of eliminating the bacterial risk in water and a biocontrol product for plant protection, still in a development phase, is today reporting its earnings for the first half of 2023, ended June 30, 2023, as approved by the Board of Directors on October 5, 2023.

At the end of 2022, Amoeba obtained approval of its active substance for biocidal use in closed cooling systems and for biocontrol use in the United States.

As requested by the Company, the Statutory Auditors carried out a limited review of the consolidated half-year accounts at June 30, 2023 and did not identify any material misstatements that would call into question the compliance of these accounts.

The half-year report is currently being issued and will be published on the Company’s website (www.amoeba-nature.com) over the coming days.

Results that reflect the start of the industrial project and a significant reduction in the debt charges

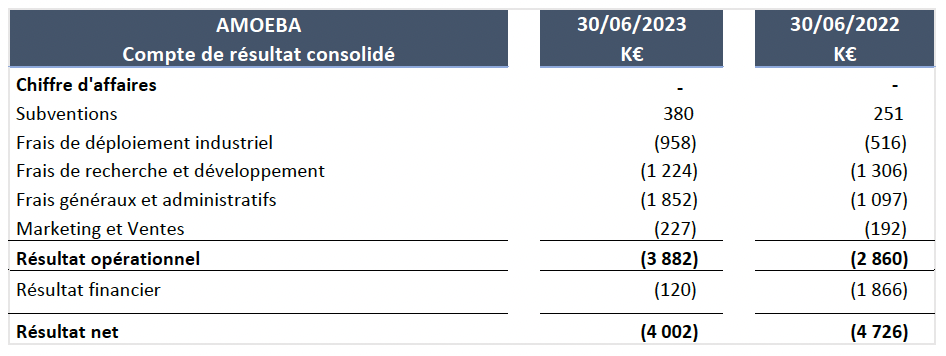

Operating income came to –€3,882K at June 30, 2023, compared with –€2,860K for the first half of 2022. No significant depreciation was recorded during the periods presented.

- The Company did not generate any revenues during the first half of 2023.

- The industrial deployment costs are €443K higher than the previous year, with this increase linked mainly to the transfer of consumable purchases and energy costs from the R&D department to the industrial deployment department.

- Research and development costs net of grants represent €1,224K, compared with €1,306K for the first half of 2022.

- Sales and marketing costs are up 18% from the previous year (€227K at June 30, 2023, versus €192K at June 30, 2022).

- Administrative costs and overheads increased by €755k compared with the previous year. This difference is mainly due to fees to secure financing and staff costs.

- The financial result is no longer impacted by bank loans, which have all been repaid.

- Half-year net income came to –€4,002K, compared with –€4,726K for the first half of 2022.

The Company’s cash position at June 30, 2023 was €3,136K, compared with €5,528K at December 31, 2022.

The reduction in the cash position reflects:

- cash flow from operating activities for –€2,221K;

- cash flow from investing activities for -€1,101K;

- cash flow from financing activities for +€927K.

At June 30, 2023, the Company’s shareholders’ equity represented €6.7m, compared with €8.2m at December 31, 2022.

The Company’s financial debt totaled €667K, comprising liabilities relating to lease obligations (€667K), as the bonds convertible into shares with an incentive program (OCAPI) had all been converted.

First half of the year marked primarily by the continued development of the biocontrol application and the new financing obtained

During the first half of 2023, Amoéba focused on the following main areas:

Industrial development:

On February 16, 2023, the Company announced that it had submitted the building permit application for its dedicated new production site for biocontrol applications, which will be located in Cavaillon in France’s Vaucluse region.

In line with the project’s schedule, the building permit application, setting out robust commitments to respect biodiversity and employees, was approved on June 12, 2023, following a three-month review. With this project, Amoéba aims to develop a dedicated industrial site of over 3,000 sq.m for the bio-production of its biocontrol agent. This major project is part of the industrialization plan launched by Amoéba in preparation for the commercialization of its plant protection products expected for early 2025.

Continuing to develop the biocontrol application:

- Collaboration with Nissan Chemical Corporation

On March 31, 2023, Amoéba announced that, under a material transfer agreement, Nissan Chemical Corporation has launched a study to assess the performance of a mixture combining one of its products with an experimental biocontrol product from Amoéba.

- Creation of the AXPERA brand

As part of its pre-commercialization plan, Amoéba has developed an international brand for its biocontrol solution, reflecting the values of innovation, performance, responsibility and renewal. On June 5, 2023, it announced that the brand name for its biocontrol solutions would be AXPERA, with its release planned for early 2025.

Field tests continuing to make progress The objectives of the tests are primarily to:

- Assess AXPERA’s efficacy and selectivity in the field on new targets (e.g. Arboriculture, Aromatic and ornamental plants, Strawberry, Garlic)

- Confirm AXPERA’s efficacy and selectivity on mildew and Uncinula necator or powdery mildew affecting grapes.

- Position the product within leading local agricultural programs in Europe.

- Assess AXPERA’s efficacy and selectivity with field tests for Soybean Rust in Brazil and Black Sigatoka affecting Bananas.

- Consolidate our efficacy data to further strengthen the applications for approval of the formulated product.

Since 2019 and at the date of the half-year report, the Company has carried out 620 tests, including 200 partner tests. It will continue with its tests in 2023.

Financing

- The Company announced the cancellation of the eighth optional tranche of 80 convertible bonds and the signing of a support contract with Redbridge Debt and Treasury Advisory, which aims to support the Company with adapting its financial strategy to its new industrial transformation challenges.

- Alongside this, Amoéba signed a new €9 million simple bond financing agreement with Nice & Green (see press release from February 15, 2023) with a view to launching its industrial project immediately.

- Amoéba also obtained €5.9m of funding from BPI France under the France 2030 program following its application for the “Agrifood Capacity and Resilience” call for projects. BPI France announced €5,917,676 of support based on a €3,550,606 grant and a €2,367,070 recoverable advance.

Coverage of the Company’s share

- The Company retained the Edison Group as an analyst to carry out a study into initiating financial coverage. This research contract, financed by the Company, aims to enable investors to broaden their understanding of the Company, which is necessary to take up positions on Amoéba shares (ALMIB).

- On April 20, Amoéba also welcomed Portzamparc – BNP Paribas Group on board to start covering its share. It began its monitoring with a “Buy” recommendation and a study entitled: “Amoeba supporting the environment”.

Governance

- At their Combined General Meeting on May 25, 2023, the Company’s shareholders decided to: renew the terms of office of Mr Plasson, Mr Dujardin, Mr Ambollet, Ms Guinard and Ms Filiatre, which had expired, for a six-year period through to the end of the Ordinary Annual General Meeting held in 2029 to approve the accounts for the year ending December 31, 2028.

- appoint Mr Jean Luc Souche (previously Biocontrol Business Developer with Amoéba) as a new director.

- The Board of Directors, which held its first session following the General Meeting, reappointed Mr Fabrice Plasson as Chairman of the Board of Directors and Chief Executive Officer for the duration of his term of office as a director.

- Valérie Filiatre, who opted to retire this year, will continue to support Amoéba’s development as a director. Jean-François DOUCET, who joined the company in May 2023, is now Deputy Managing Director.

“I would like to sincerely thank Valérie for her work with the company since 2014 and her commitment working alongside me during all these years. I wish her every happiness in her new projects, and I am delighted that she will continue to support the company as a director”, confirms Fabrice Plasson, Chairman and CEO.

Events since 30 June

On the biocontrol application

Amoéba confirms that the regulatory timetable for applying for approval of the biocontrol active substance is in line with the company’s forecasts (see press release from July 13, 2023).

Financing

The Company has drawn down the 1st tranche of 100 straight bonds subscribed to in favour of Nice & Green SA for a net amount of €2,820,000 paid in July 2023 and August 2023.

The Company is continuing its search for additional financing. Following an initial financial diagnosis and structuring phase carried out by Redbridge Debt and Treasury Advisory, the Company is continuing its fund-raising strategy with KPMG.

Investments

The Company confirms the progress of its project for a production site dedicated to biocontrol applications and announces that the deed of purchase for the land to house this plant in Cavaillon was signed on September 26, 2023.

Development and outlook

Biocontrol application

The Company is moving forward with its project to develop its first biocontrol plant. This plant, which will be located in Cavaillon in the South of France, is expected to be operational during the first quarter 2025 to align with sales of the biocontrol products.

Biocide application

Following the US EPA’s preliminary favorable decision on the use of the amoeba Willaertia Magna C2c Maky in closed cooling systems (see press release from August 10, 2022), Amoéba has started to look for a partner that will be able to take on the production and/or marketing of its biocide product in the United States. This search is still ongoing.

On the reporting date for the accounts, the Company has sufficient net working capital to cover its obligations and cash requirements through to June 30, 2024, and believes that it is in a position to deliver on the commitments that it has made to date.

Read the press release in PDF :