Amoeba announces its half-year results for 2022

Amoéba announces its half-year results for 2022

Chassieu (France), September 29, 2022 – 6:00 pm – AMOÉBA (FR0011051598 – ALMIB), producer of a biological biocide capable of eliminating bacterial risk in water and human wounds, and of a biocontrol product for plant protection, still in the development phase, today announced its half- yearly results for 2022.

The Board of Directors, which met on 29 September 2022, approved the Company’s consolidated accounts for the first half of 2022.

The Statutory Auditor has carried out a limited review at the Company’s request of the consolidated financial statements for the six months ended 30 June 2022 and has not identified any material misstatements that would call into question their conformity.

The half-year report is being issued and will be available on the company’s website (www.amoeba- nature.com) in the next few days.

Operational results in line with 2021 and financial debt restructuring

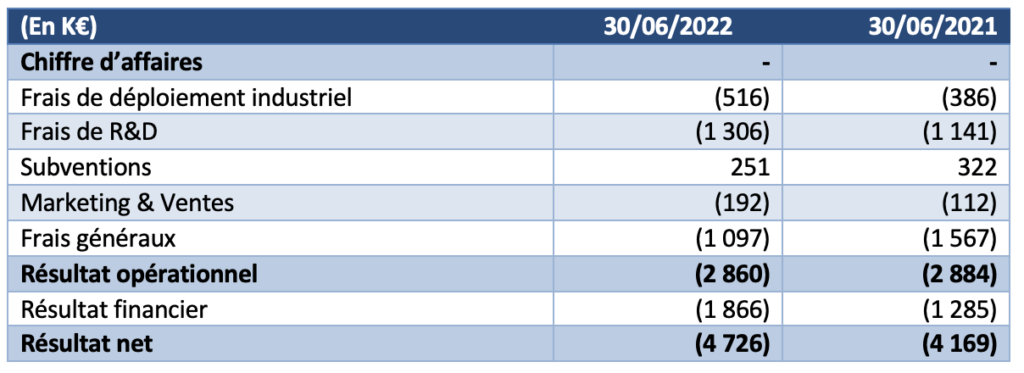

The operating result for the six months to 30 June 2022 was a loss of K€2,860, compared with a loss of K€2,884 in the first half of 2021. No significant impairment was recorded during the periods presented.

- The company did not generate any revenue during the first half of 2022.

- Industrial deployment costs were €130k higher than the previous year.

- Research and Development expenses net of grants were €1,055k, compared to €819k in H12021.

- Marketing and sales expenses are up 71% on the previous year (€192k at 30 June 2022 versus €112k at 30 June 2021

- General and administrative expenses were down at 30 June 2022 to €1,097k, or -30% compared to the previous year.

- The financial result mainly includes interest expenses related to bank loans of €1,549k (compared to €1,434k in the first half of 2021) and changes in the fair value of financial derivatives of €335k (compared to €154k in 2021).

The net result for the first half of the year is therefore -€4,726k.The Company’s cash position at 30 June 2022 was €2,752k compared to €7,274k at 31 December 2021.

The decrease in cash is explained by :• cash flow from operations of – €2,682k;

• cash flow from investment activities of -€40k;

• cash flows from financing activities of – €1,802k, mainly due to the issue of bonds for €5,760kin the first half of 2022 and the full repayment of the EIB loan for €6,070k.As at 30 June 2022, the Company’s shareholders’ equity amounted to €3.7m compared to €0.2m as at 31 December 2021.The Company’s financial debt amounted to €4.8m. It is mainly made up of the OCAPI loan (€4.3 million) and debts linked to rental obligations (€0.4 million), the EIB loan having been fully repaid on 30 June 2022.

A first semester mainly marked by the progress of regulatory marketing files, the continued development of the biocontrol application and the early repayment of the EIB loanDuring the first half of 2022, Amoéba focused on the following main areas:

1. Follow-up of the marketing authorisation applications for the biocontrol and biocideapplications

used in accordance with good plant protection practice and under realistic conditions of use.

• Biocidal application

On 03 May 2022, the Company announced that the MCCAA (Malta Competition and Consumer Affairs Authority), the competent authority of the reporting Member State (Malta) evaluating the application for approval of the biocidal active substance “Willaertia magna C2c Maky”, recommended its non-approval for biocidal use in cooling towers in Europe.

On the basis of the application dossier for approval of the biocidal active substance “Willaertia magna C2c Maky”, the Maltese authority concluded in its draft report that the active substance is not likely to meet the approval criteria, considering that the innate efficacy has not been sufficiently demonstrated and that a Trojan horse effect cannot be excluded under realistic conditions of use. However, a few weeks later, the US EPA issued a favourable pre-notification for the use of the amoeba Willaertia Magna C2c Maky in closed cooling systems (see below “Recent developments and prospects”) in the United States.

2.Further development of the biocontrol application and launch of a new massive field trial campaign for 2022

In the first half of 2022, the company has started a new field trial campaign for its biocontrol product, focusing on :

- Trials for the European marketing authorisation of the selected formulation on grapevine downy mildew

- After the excellent results obtained in 2021, the intensification of the powdery mildew programme on vines

- Intensification of the programme against mildew and powdery mildew on market garden crops in order to prepare future MA applications

- Continuation of the cereals programme, in particular against rusts, septoria and fusarium head blight.

- Trials on new targets: in particular apple scab, a major subject, following promising results obtained in climatic chambers.

- Continued evaluation against soybean rust and coffee rust FinancingThe Company announced the issuance of the fourth and fifth tranches of 60 bonds convertible into shares in the framework of its bond financing with an incentive programme concluded with Nice & Green.In addition, Amoéba finalised the restructuring of its debt by prepaying the entire EIB loan.

3.Financing

The Company announced the issuance of the fourth and fifth tranches of 60 bonds convertible into shares in the framework of its bond financing with an incentive programme concluded with Nice & Green.In addition, Amoéba finalised the restructuring of its debt by prepaying the entire EIB loan.

4.Changes in governance

The General Meeting of Shareholders of 24 May 2022 ratified the appointment as directors of Mr Philippe DUJARDIN to replace Mr Pascal REBER, who resigned and Mrs Sylvie GUINARD, replacing Mrs Claudine VERMOT-DESROCHES, who has resigned.

Mr Philippe DUJARDIN and Ms Sylvie GUINARD will hold office for the remainder of their predecessors’ term of office, i.e. until the end of the Ordinary General Meeting of shareholders to be held in 2023 to approve the financial statements for the year ending 31 December 2022.

In addition, the General Meeting of Shareholders of 24 May 2022 ratified the appointment of Mr Pascal REBER as Censeur.

Mr Pascal REBER will exercise the said functions for a period of three (3) years, i.e. until the end of the Ordinary General Meeting of Shareholders to be held in 2024 to approve the accounts for the financial year ending 31 December 2023.

Impact of the COVID-19 health crisis and the war in Ukraine on the accounts at 30 June 2022

At the date of this half-yearly report, the Company considers that its activities have not been significantly impacted by the health crisis.

The production of the active substance necessary to carry out the field tests could continue under normal operating conditions. The health crisis had no impact on the preparation and monitoring of current regulatory dossiers. The Company made limited use of the partial activity mechanism and did not request an EMP.

The Company does not yet market its products and does not recognise any significant turnover to date. The Covid-19 crisis had little impact on its income statement.

The Company has no activities in Russia or Ukraine. However, the Company’s activities could be impacted by the direct or indirect consequences of the conflict, which it is not possible to quantify precisely at this time.

Recent developments and prospects

Following the US EPA’s preliminary favourable decision on the use of the amoeba Willaertia Magna C2c Maky in closed cooling systems (see press release of 10 August 2022), Amoeba is currently refining its market analysis on this restricted type of system in order to evaluate its commercialization potential.

On 29 September 2022, the company has received from the United States Environmental Protection Agency (US EPA) a positive pre-decisional determination following its assessment of the application dossier for the use of the Lysate of Willaertia magna C2c Maky as a biocontrol active ingredient (biopesticide) in agriculture. The US EPA has concluded that the Lysate of Willaertia magna C2c Maky has a low toxic profile for human health and the environment, and that its “mode of action contributes to its attractiveness as viable alternative to conventional pesticides making it a valuable addition to the pesticide tool kit”. Therefore, the EPA is proposing to grant the unconditional registration of lysate of Willaertia magna C2c Maky as a new active ingredient and supports a pesticidal food use and non- food use.

The Company is pursuing its project to set up its first biocontrol plant. This plant would be located in France and should be operational in 2024 to satisfy the start of the marketing of biocontrol products. It should represent an estimated investment of between 15 and 17 million euros for which Amoéba will have to seek new financing from the 4th quarter of 2022.

At the date of closing of the accounts, the Company has sufficient net working capital to meet its obligations and cash requirements over the next twelve months, as the Company believes it can meet its commitments.