AMOEBA : insuance of the sixth tranche of 60 bonds convertible into shares

Amoéba announces the issuance of the sixth tranche of 60 bonds convertible into shares.

Chassieu (France), September 15, 2022– 5.45 pm – AMOEBA (FR0011051598 – ALMIB), producer of a biological biocide capable of eliminating bacterial risk in water and human wounds, and a biocontrol product for plant protection, still in a development phase, announces the issuance of the sixth tranche of bonds convertible into shares (“OCAs”) of its new bond financing with incentive program, namely 60 OCAs numbered from 301 to 360 fully issued to Nice & Green S.A.

This issue is part of the agreement entered into with Nice & Green S.A. on December 16, 2020 with a view to setting up a bond financing with a profit-sharing program through the issuance of 480 OCAs with a nominal value of EUR 50,000 each, representing a total nominal amount of the bond issue of EUR 24,000,000 (the “Issuance Agreement”).

The Chairman and Chief Executive Officer of the Company, using the sub-delegation granted to him by the Board of Directors at its meeting on June 24, 2021, decided to issue on September 15, 2022, 60 OCAs numbered from 301 to 360 to the benefit of Nice & Green S.A. corresponding to the sixth tranche of the bond financing.

As provided for in the issuance agreement, these OCAs were fully subscribed at a price equal to 96% of their nominal value, representing a sixth tranche of OCAs for a total net amount of EUR 2,880,000.

As a reminder, the Company maintains on its website a monitoring table of the OCAs and the number of Amoéba shares in circulation (see Investors section / Regulatories information / Other information).

As an indication, the theoretical impact of the issue of this sixth tranche of OCAs is presented in the tables below in accordance with the OCA conversion formulas on the basis of 92% of the lowest volume-weighted average trading price of the Amoéba share at closing (as published by Bloomberg) over the six (6) trading days immediately preceding September 15, 2022, namely 0.9295 euros.

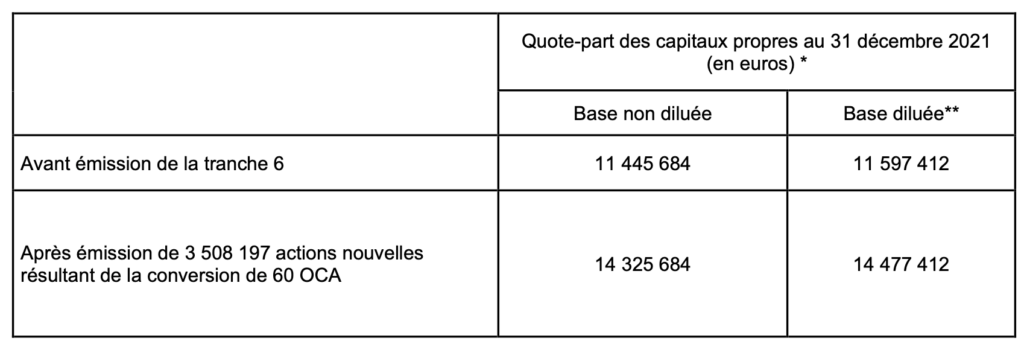

– Impact of the issue on the share of shareholders’ equity per share (calculation based on Amoéba’s shareholders’ equity as at december 31, 2021, prepared in accordance with International Financial Reporting Standards (IFRS) adjusted for capital increases completed up to September 15, 2022 i. e. 11,445,684 euros and the number of shares comprising the Company’s share capital as at September 15, 2022, i. e. 42,472,936 shares) :

(*) amount of shareholders’ equity at 31 december 2021 prepared in accordance with IFRS international financial standards and adjusted for capital increases completed until September 15, 2022

(**) assuming:

- the full exercise of the business creator share subscription warrants and share subscription warrants issued and allocated by Amoéba, exercisable or not, giving the right to subscribe for 200,000 new shares

- the definitive allocation of the conditional rights to receive 25,000 free shares fully subject to a condition of uninterrupted presence.

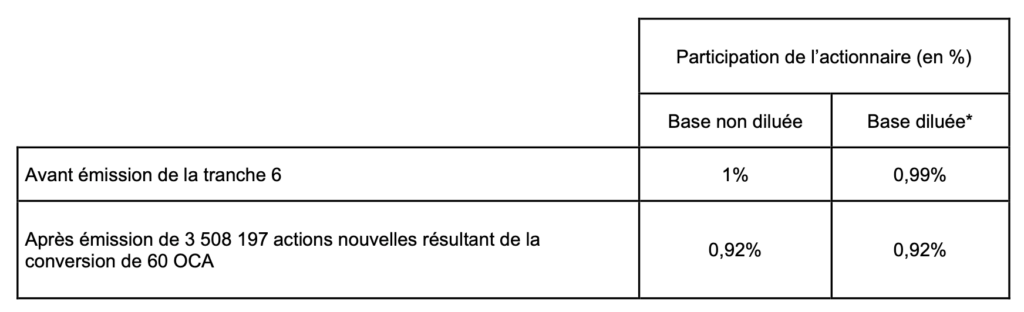

– Impact of the issue on the participation of a shareholder holding 1% of Amoéba’s share capital prior to the issue of the sixth tranche (calculation based on the number of shares comprising Amoéba’s share capital as at September 15, 2022, i.e. 42,472,936 shares) :

(*) assuming:

- the full exercise of the business creator share subscription warrants and share subscription warrants issued and allocated by Amoéba, exercisable or not, giving the right to subscribe for 200,000 new shares

- the definitive allocation of the conditional rights to receive 25,000 free shares fully subject to a condition of uninterrupted presence.

“The objectives of the financing programme with Nice & Green SA were to develop our biocontrol application worldwide on field crops, to continue the examination of our regulatory dossiers and to restructure the company’s debt while strengthening its equity (see press release of 21 December 2020). To date, even before the end of the programme, I am pleased to note that these objectives have been achieved with, in particular, the implementation of 194 field trials between 2021 and 2022, the positive recommendation from Austria for the approval of our biocontrol active substance and the full early repayment of our loan from the EIB. Amoéba can now look forward to a new phase in its development and financing with the construction of a dedicated biocontrol plant and the search for new opportunities based on the use of the amoeba Willaertia magna C2c Maky,” said Fabrice Plasson, Chairman and CEO of Amoéba.